As we come out of the global travel restrictions of the last few years, we are starting to see expats return to China. For those that need to purchase independently, we have prepared our Guide to The Most Popular Expat Health Insurance Plans in China.

This guide, along with our free quote comparison and market experience will help new expat families navigate the China health insurance market.

Families new to China should be aware that medical treatment in China can be prohibitively expensive. And medical treatment costs need to be paid upfront by the patient. Therefore it is imperative that your family is covered by a comprehensive health insurance program. This can be purchased either independently or by your employer.

At China Expat Health we work with all the major health insurer brands. And over the last 20 years we have served many thousands of expat families in this rapidly changing market. As a result, we’re in a good position to share which insurance companies, plans and benefits are popular with expats in China, and why.

To understand which insurance companies and plans are popular, first you need to understand what benefits expats value most. Most medical insurance plans are broken down into two main categories:

Category 1: A Core (basic) Benefit Plan

Which provides cover for inpatient (hospitalisation) treatment – the essential building block of all good health insurance programs, and usually includes evacuation and repatriation benefits. To summarise:

- Inpatient (hospitalization) Benefits

- Evacuation*

- Repatriation*

Category 2: A Comprehensive Benefit Plan

Which provides cover for inpatient (hospitalisation) treatment AND outpatient (clinic / GP visits) treatment, and usually includes evacuation and repatriation benefits. To summarise:

- Inpatient (hospitalization) Benefits

- Outpatient (clinic / GP visits) Benefits

- Evacuation*

- Repatriation*

Optional Upgrades

Then there are Optional Upgrades which are supplementary benefits you can personally choose to tailor the benefits to your family. These Optional Upgrades are generally only available when you upgrade the Category 2 Comprehensive Benefit Plan. These Optional Upgrades include:

- Dental

- Wellness (annual check ups)

- Optical (eyeglasses

- Maternity

* The premium insurers include these benefits as core benefits, however the lower cost insurers offer them as optional upgrades.

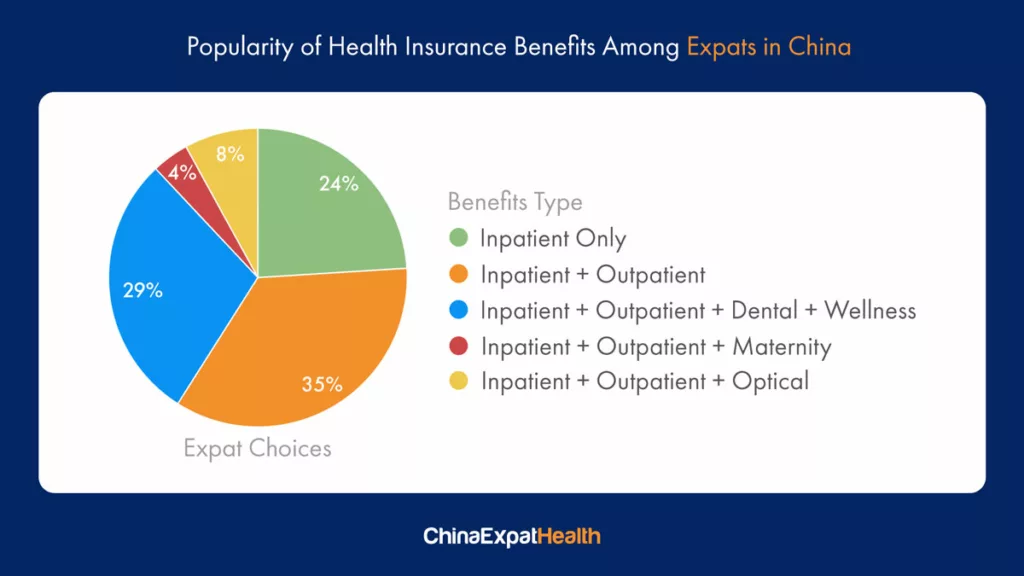

Take a look at the below chart which shows the The Most Popular Expat Health Insurance Plans in China

76% of clients have a Comprehensive Benefit Plan, including some level of Optional Upgrades.

Only 24% of clients have the Core (basic) Benefit Plan.

By far, The Most Popular Expat Health Insurance Benefits Plans in China for most families is a Comprehensive Benefit Plan, with dental and wellness coverage being the most popular Optional Upgrades. Maternity and Optical Optional Upgrades are relatively niche choices and are only chosen by families with these specific requirements.

Did You Know You Can Choose Different Hospital Networks, With Different Copay options?

Another consideration when buying expat medical insurance in China is whether or not you want access to the High-Cost Provider network of hospitals and clinics (otherwise known as HCP’s)?

What is the high-cost provider network of hospitals and clinics? Quite simply, it is a list of the higher cost hospitals and clinics around China. These are usually the private facilities, with multi language capabilities, and generally a more international style of treatment, service and decor.

As noted earlier, medical treatment in China can be prohibitively expensive, and the High Cost Providers are the facilities where you don’t want to be paying the bill personally!

Insurers therefore create a list** of what they consider to be HCP’s, and you will pay the full premium if you wish to be covered at HCP’s. Conversely if you choose a 20% copay at HCP’s, or to NOT include cover at HCP’s, the insurer will offer a discounted premium. Discounts can range from 15% to 35% depending on the insurer.

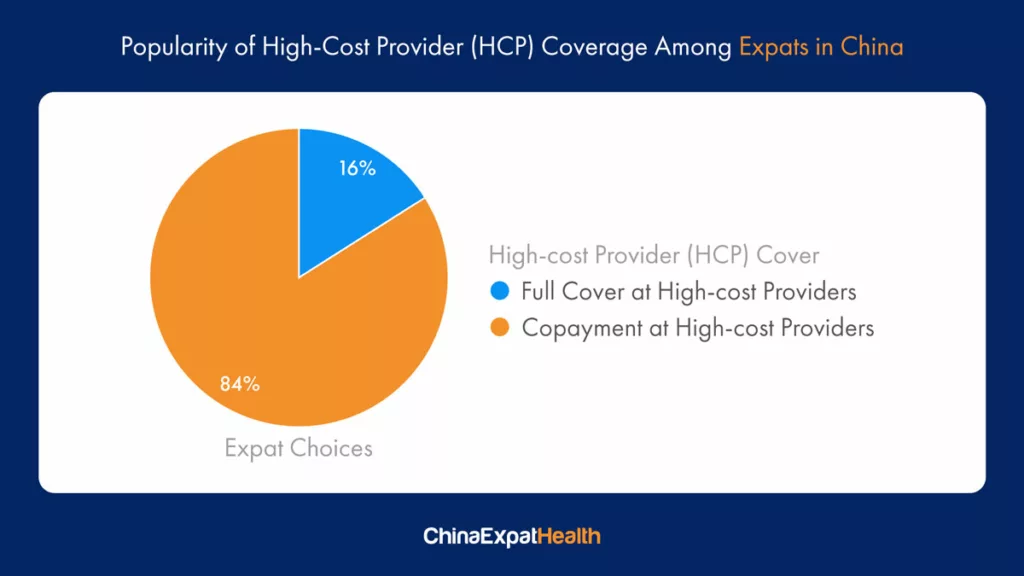

What is the most popular selection for hospital networks?

The most popular option is a 20% copay at the HCP’s, where the user still can access the HCP network though they must pay 20% of the treatment costs (which is called a HCP 20% copay plan).

As you can see with 84% choosing it, the co-payment option is very popular. The discounts available on these options can be significant and make it difficult to ignore. However, we do find the high-cost provider fully covered option more popular with our Beijing clients as there aren’t many good treatment facilities outside of United Family Hospital – which is number 1 on the high-cost list.

** Each insurer has their own HCP list, and these can and are updated at any time.

Deductibles Options

Given the popularity of high-cost provider copayments, one would think that deductible options would also be popular. However this isn’t the case, only 3% of clients choose plans with deductibles.

It may seem a little odd as adding a small outpatient or inpatient deductible can reduce the price of insurance quite a bit. The main reason is that adding a deductible can complicate the direct billing process with hospitals and clinics, so to avoid potential hassles most expats do not have deductibles in China, instead preferring the 20% copay at High Cost Providers option listed above.

China Medical Insurance Companies And Their Plans

So to recap, the most popular plan option is the Comprehensive Benefit Plan which includes inpatient and outpatient cover and dental and wellness Optional Upgrades, with a Nil or 20% copay at High Cost Providers.

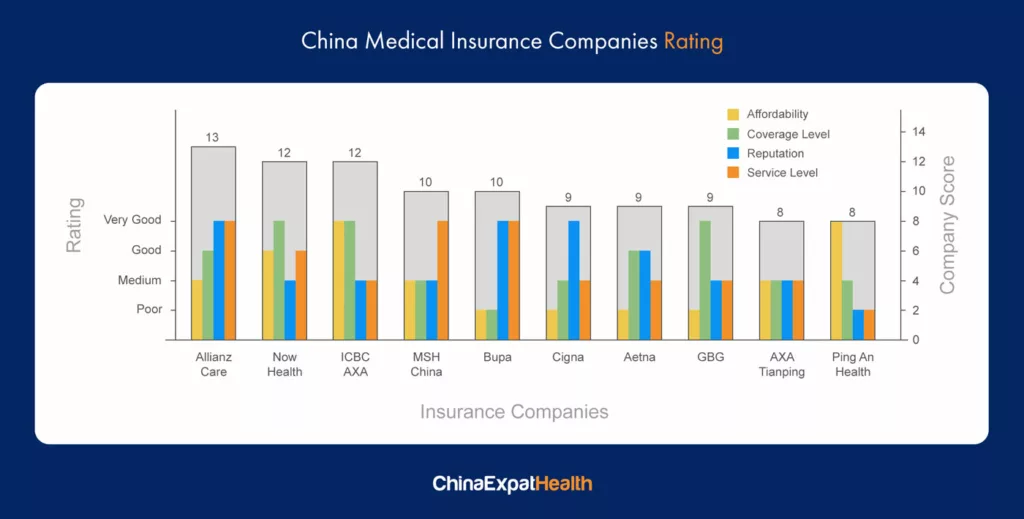

So how do the insurer’s and their plans stack up against these requirements? We scored the major health insurance companies based on 4 factors: affordability and coverage level for the standard package and comprehensive package plans, as well as the insurance companies’ reputation and service levels.

As you can see, three insurance companies perform better than the rest, Allianz Care, Now Health and ICBC AXA. Over 80% of our clients choose one of those three insurance companies. There are exceptions, particularly if you want maternity insurance or Worldwide cover including the United States.

To answer the question of what are The Most Popular Expat Health Insurance Plans in China? The answer is Allianz Care, Now Health and ICBC AXA.

How To Choose Between The 3 Most Popular Insurance Companies?

People who feel safer with a well-known international brand tend to choose Allianz Care, as it offers the perfect mix of brand value, service levels (particularly international service levels) – compared with the higher cost. Allianz Care plans are also portable, which means if you leave China you can take your insurance with you, which is extremely important to anyone with pre existing conditions who needs to continue coverage in another country.

Now Health is attractive because the price sits in between ICBC AXA and Allianz and offers a lot of benefit design flexibility. Now Health is not one of the traditional health insurance powerhouses, which discourages some people, however, the cover is great. In addition, cover with Now Health is more accessible for members with pre existing conditions (their underwriters are very considerate), so if you have pre-existing conditions, you will have a much higher chance of being accepted with good terms. Now Health plans are also portable to other countries.

ICBC AXA offers the most bang for your buck and has good cover and reliable service if you’re mainly using the insurance within Mainland China. If you want a comprehensive package with dental and wellness then they offer the best value plans meeting these requirements. The plans are flexible and there are a number of ways to reduce the premium. ICBC AXA plans are not portable to other countries, meaning when you leave China you cannot continue your insurance with ICBC AXA. For a no-frills insurance plan that works, ICBC AXA is a great choice option.

Which Area of Cover Is The Most Popular for expat health insurance plans?

Around 85% of China based expat families choose the Worldwide Excluding the US area of cover. By excluding full cover in the US, customers can save significantly on the premiums, and it is for this reason that Worldwide excluding the US area of cover is the most popular.

You can select from four main Area of Cover options offered by insurers in China:

- Worldwide including the US (highest cost)

- Worldwide excluding the US (most popular)

- Greater China including Hong Kong, Taiwan & Macau (lower cost)

- Mainland China (lower cost)

With most expats traveling outside of China multiple times during the year, whether for business or leisure, they need cover both inside and outside of China, which is why they select Worldwide excluding the US. Your family will then be covered worldwide in the event of an accident or illness.

Why not select Worldwide including the US? Price is the leading driver here as Worldwide including the US cover is roughly double the price of Worldwide excluding the US.

Furthermore, it is worth noting that the more reputable insurers will cover emergency treatment in the US (not scheduled treatment) on the Worldwide excluding the US, so this can be a cost effective way to ensure you have great cover even if you take short visits to the US.

Expats that do buy Worldwide including the US tend to be US nationals, or work for US companies and require multiple visits to the US each year. For those who are interested in Worldwide including the US, the better value for money options come from Now Health, Allianz and AXA Tianping.

Lastly, the lowest cost option is Greater China including Hong Kong, Taiwan & Macau or Mainland China (only) designed for the price conscious, or customers that rarely leave China. With the reduced geographical area of cover, these plans will reduce your premium costs significantly compared to the worldwide cover options. For those who are interested in Mainland China (only) the better value for money options come from MSH and Prosper.

Want to know the best option for your family? Contact us

If you want to know more and have questions, why not speak to one of our expert consultants? We’ll help you compare the prices and benefits of the most suitable options, and you’re under no obligation to move forward with any options we present. Lastly, our service is free to you, the customer as the insurer pays 100% of our fees. So get in touch for a free quote and the best advice in China.